stamp duty for tenancy agreement malaysia

Stamp duty payable rm925000 x rm300 rm1000 rm277500 appendix. Click on the Tambah Permohanan Baru to begin with.

How To Write Your Own Tenancy Agreement In Malaysia Recommend My

Some examples of documents where stamp duties are applicable include your Tenancy Agreement Instrument of Transfer.

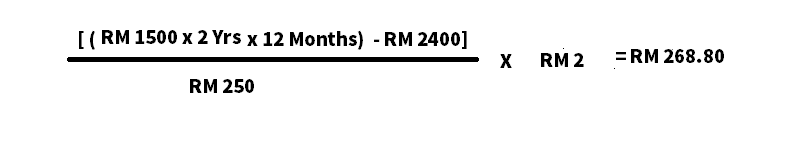

. Malaysia Tenancy Agreement Stamp Duty Fee Calculation Eddie For contracts that are signed for anywhere between 1 to 3 years the stamp duty rate is RM2 for every RM250 of. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the stamp duty is 1000 for each copy. The person liable to pay stamp duty is set out in the.

RM 1 for every RM 250 of the. The Web App below will assist you to calculate Stamp Duty. Basically the Stamp Duty for Tenancy Agreements spanning less than one year is RM1 for every RM250 of the annual rent in excess of RM2400.

The Property Stamp Duty scale is as follow. Next RM 90000 rental 20 of the monthly rent. Rental for every RM 250 in excess of RM 2400 rental Less than 1 year.

When we signed a tenancy agreement in Malaysia the Tenant is required to pay Stamp Duty as a form of tax to the government. There are 2 types of Stamp Duty. The standard stamp duty chargeable for tenancy agreement are as follows- Rental for every RM 250 in excess of RM 2400 rental Who should bear the legal costs for the preparation of the.

First the duration of the agreement is the second is the annual rent of RM2400. For the first RM100000 1 From RM100001 to RM500000 2 From RM500001 to RM1mio 3 The subsequent amount is 4. Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P.

The stamp duty for a tenancy agreement in Malaysia is calculated as the. The standard stamp duty chargeable for tenancy agreement are as follows. Once you at the Login Page you will see there is No submission.

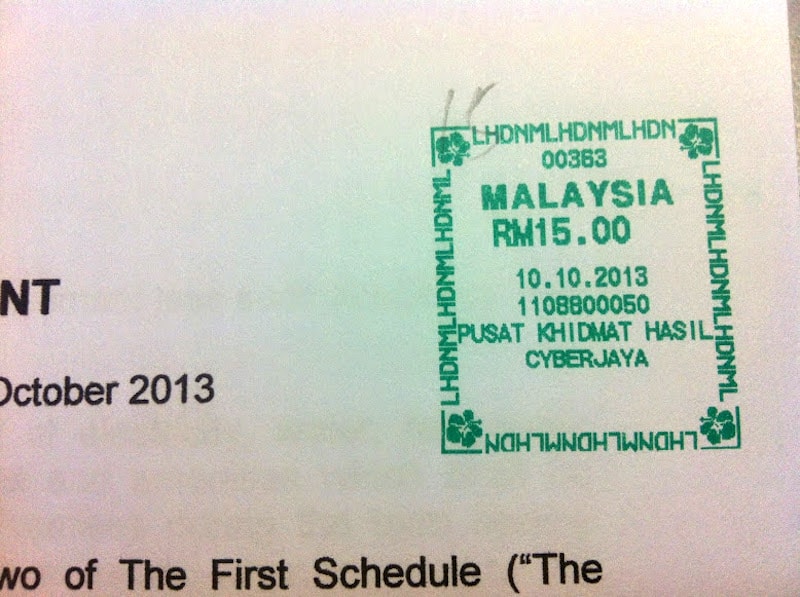

The Tenancy Agreement that has been signed need to be brought to any LHDN office for stamping within 30 days after the commencement. First RM 10000 rental 50 of the monthly rent. Yearly Rental Amount RM 2400 250 X Price for every RM 250 of rent Duty Stamp Cost The Price for every RM 250 per rent in a 1 year tenancy agreement.

Between 1- 3 years. In short Stamp Duty is a tax charged on legal documents. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord.

It is common practice for the. Stamp duty on apartment rentals takes into account two factors. Key in all the Tenancy Details.

Legal Fee for Tenancy Agreement period of above 3 years. Based on the table below this means that for. Who should pay the Tenancy.

Stamp duty is a tax on legal documents in Malaysia. Stamp duty for tenancy agreement Malaysia for LHDN Usually the landlord will arrange for the stamping of the tenancy agreement. The stamp duty for a tenancy agreement in Malaysia is calculated as the.

Malaysian Ringgit RM loan agreements generally attract stamp duty at 05 However a reduced stamp duty liability of 01 is available for RM loan agreements or RM loan instruments. For contracts that are signed. Select the choice as below.

An instrument is defined as any written document and in general- stamp duty is levied on legal commercial and financial instruments. Your stamp duty is RM1000 if you rent. The tenancy agreement will only be.

Duration of Tenancy Agreement. Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. Ad valorem Duty the amount of Stamp Duty depends on the type and value of the instrument.

More than RM 100000.

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Who Pays For The Tenancy Agreement In Malaysia

Know Your Stuff Understanding The Basics Of Renting The Edge Markets

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

How To Calculate Tenancy Agreement Stamping Fee

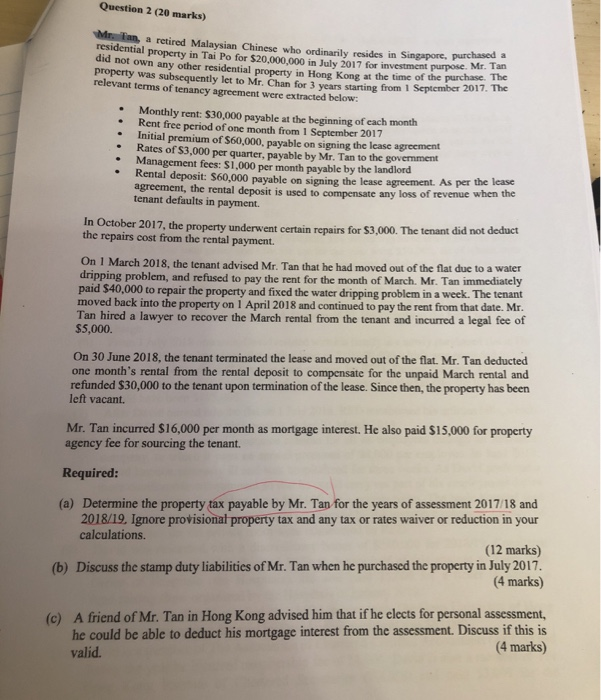

Question 2 20 Marks Milan A Retired Malaysian Chegg Com

Stamping A Contract Is An Unstamped Contract Valid

728 A C Roessler Cachet 1933 Century Of Progress Fdc P 16a Ebay

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Tenancy Agreement Stamp Duty Calculator Malaysia Creatifwerks

Tenancy Agreement Malaysia Properly

Ops Alaska Atlas Of An Undiscovered Country

Tenancy Agreement Stamping Lhdn We Was My Property Buddy Facebook

Mot And Stamp Duty In Malaysia Maxland Real Estate Agency

What Is A Tenancy Agreement In Malaysia Iproperty Com My

Why Could This Green Chop Cost You Thousands Of Ringgit Asklegal My

Rental Agreement Stamp Duty Malaysia Speedhome

Financially Happy Dot Com Calculate Stamp Duty For Your Tenancy Agreement

Comments

Post a Comment